Elders’ Settlement Trust Payments

First quarter Elders’ Settlement Trust payments of $450 will be mailed or directly deposited by 6 p.m. Alaska Standard Time on Friday, March 8 to eligible Elders with a valid mailing address on file as of 3 p.m. Monday, Feb. 28. Original shareholders who are 65 years of age or older and who own at least one share of CIRI stock on March 8 are eligible to receive the payment.

As has been previously explained, it is anticipated the Trust portfolio will only be able to fund Elders’ payments for the first three quarters of 2019, and the Trustees have been working with CIRI to explore options to ensure Elders continue to receive quarterly payments. In the interim, the CIRI Board has approved providing the necessary funding to cover any shortfall, thereby ensuring that all eligible Elders will receive full payments in 2019.

The 2017 Tax Cuts Jobs Act allows Alaska Native corporations to place assets in a settlement trust to help finance trust benefits, including shareholder dividends and Elders’ distributions. CIRI has been evaluating the best options to take advantage of the new rules to benefit its shareholders and plans to present a resolution to shareholders at the 2019 Annual Meeting establishing a CIRI Settlement Trust. Watch for additional information in the coming months.

Dividend Reminder

CIRI’s dividend policy states that the total dividend payment to shareholders in any given year is equal to 3.50 percent of total shareholders’ equity, calculated as of December 31 of the prior year. Dividend amounts are typically able to be confirmed shortly before the date of record for the first quarter dividend, which, this year, falls on March 21. As in the past, once available, dividend amounts will be announced on the dividend hotline, which may be reached at (907) 263-5100 or toll free at (800) 764-2435 (CHEK), and the website distribution schedule will be updated.

Direct Deposit/Remote Deposit

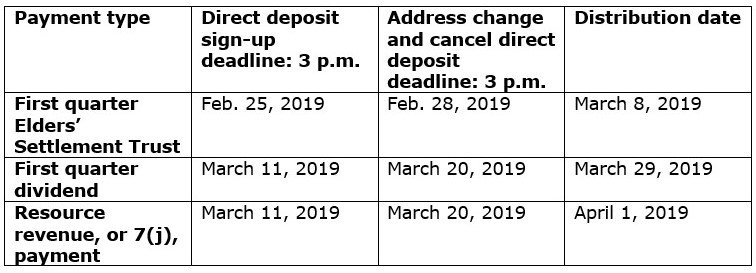

CIRI urges shareholders who receive their dividends in check form to consider either implementing direct deposit or taking advantage of remote deposit. Both options are fast, easy and eliminate the need to drive to the bank and stand in line. The deadline to sign up for direct deposit or change an existing direct deposit instruction is 3 p.m. on Feb. 25 for the first quarter Elders’ distribution and 3 p.m. on March 11 for the first quarter dividend. (Note: When remotely depositing a check, it’s a good idea to make a note on the check so you don’t attempt to cash it again. If a check is cashed twice, you are legally liable to repay the amount of the overpayment.)

Shareholders who participate in direct deposit and have a current CIRI mailing address are also eligible to participate in quarterly prize drawings. Direct deposit forms are available from Shareholder Relations and at ciri.com. To cancel direct deposit, please submit a signed, written request prior to 3 p.m. on the specified deadline. If you have a Qenek portal account, you can cancel your existing direct deposit instruction online via the portal.

Address Changes

Checks and vouchers are mailed to the address CIRI has on record as of the specified deadline. If your address has changed, be sure to update your address with both CIRI and the U.S. Postal Service. These addresses must match or your CIRI mail may not reach you. When CIRI mail is undeliverable, distributions are held and the shareholder does not qualify to participate in any prize drawings until the address is updated. This is true even if a shareholder has his or her dividends electronically deposited.

CIRI address changes may be submitted online via the Qenek portal. Alternatively, you may submit a completed CIRI address change form – available at ciri.com – or a signed, written request that includes a current telephone number. Address change forms and requests can be scanned and emailed to shareholderrecords@ciri.com, mailed to CIRI at PO Box 93330, Anchorage, AK 99509, or faxed to (907) 263- 5186. If faxed, please call Shareholder Relations as soon as possible to confirm receipt. Forms and information on changing your address or submitting a mail-forwarding request with the U.S. Postal Service are available at www.usps.com or your local post office.

Please be aware that if you fail to notify CIRI of a new address before a specified deadline and your check is sent to your old address, CIRI cannot reissue that check to you unless it is either returned to us, or a minimum of 90 days has elapsed. A list of shareholders who do not have a current mailing address on record is continually updated and may be found on the CIRI website.

Tax Reminder

As a reminder, CIRI does not withhold taxes from distributions; however, shareholders who anticipate owing tax on their distributions have the option of making quarterly estimated tax payments directly to the IRS. To find out more about applicable federal and state tax requirements or making quarterly estimated tax payments, please consult with a tax advisor or contact the IRS directly.