So you don’t have a valid, up-to-date Stock Will on file with CIRI: What’s the big deal?

While it’s not comfortable to think about what happens to your CIRI stock after you die, it is important. Under ANCSA and Alaska law, CIRI stock is subject to special estate settlement procedures. The law requires that CIRI determine the proper heirs of CIRI stock in accordance with a valid will or under Alaska laws of intestate succession if there is not a valid Will.

One way a CIRI shareholder may specify who should receive their stock is by completing a CIRI Stock Will. Here’s an example of how complicated a CIRI stock estate settlement can be without a valid will:

Shareholder A died without a valid will for his CIRI shares. He wasn’t married, had no children and his parents died before him. Although he had five siblings, only his sister survived him. His four brothers passed away before he did; all four left children, and those children were still alive at the time of Shareholder A’s death.

Because there was no will, no surviving spouse, no children and no surviving parent, the current law required that Shareholder A’s CIRI stock be divided into as many equal portions as there were: 1) surviving descendants in the generation nearest Shareholder A’s deceased parents that contained one or more surviving descendants; and 2) deceased descendants in the same generation who left descendants. In this case, each surviving descendant in the nearest generation (i.e., Shareholder A’s sister) is allocated one portion, with the remaining portion combined and divided in the same manner among the surviving descendants of the deceased descendants (i.e., Shareholder A’s four deceased brothers).

Confused yet? Basically, in accordance with the law and CIRI’s fractional share policy, Shareholder A’s sister was allocated one fifth of the shares, with the remaining four-fifths combined and divided between the children of Shareholder A’s predeceased brothers.

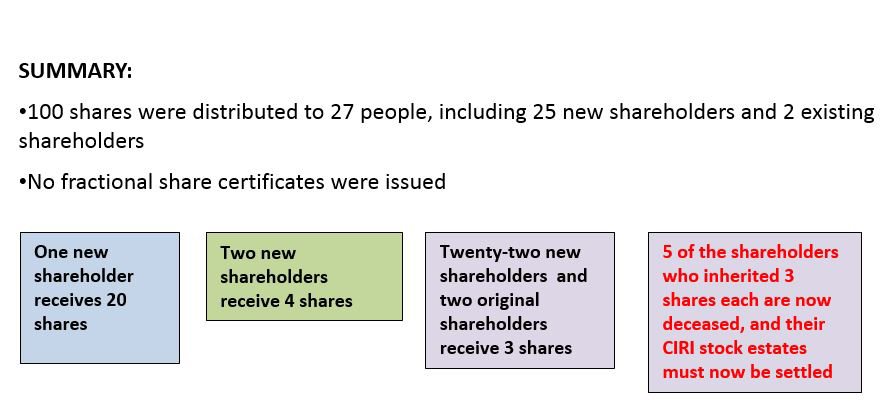

In the end, Shareholder A’s 100 shares were distributed to 27 people, 25 of whom were new shareholders. Unfortunately, five of the shareholders who inherited three shares each are now deceased — which means their CIRI stock estates must now be settled. (See graphic below.)

As you can see, settling the estates of shareholders who don’t have a valid Will on file can be complicated and difficult. The same is true if a shareholder dies with an out-of-date Will on file. (Marriage, divorce, the birth or adoption of children, the death of a designated beneficiary, the inheritance of additional shares and giving or receiving a gift of stock are all reasons to complete a new Will.)

You can make sure your shares pass according to your wishes by filing a valid up-to-date CIRI Stock Will with CIRI Shareholder Relations to ensure that your CIRI Stock Will is valid and current. Alternatively, You may complete a general will; however, it is important to note that an earlier CIRI Stock Will controls the distribution of your stock unless your later-dated General Will specifically identifies and disposes of your CIRI stock. As an added bonus, by having a valid Will on file with CIRI that complies with its fractional share policy, you’ll be eligible for monthly and quarterly prize drawings!

Ready to complete your CIRI Stock Will? Visit ciri.com/shareholders to get started!