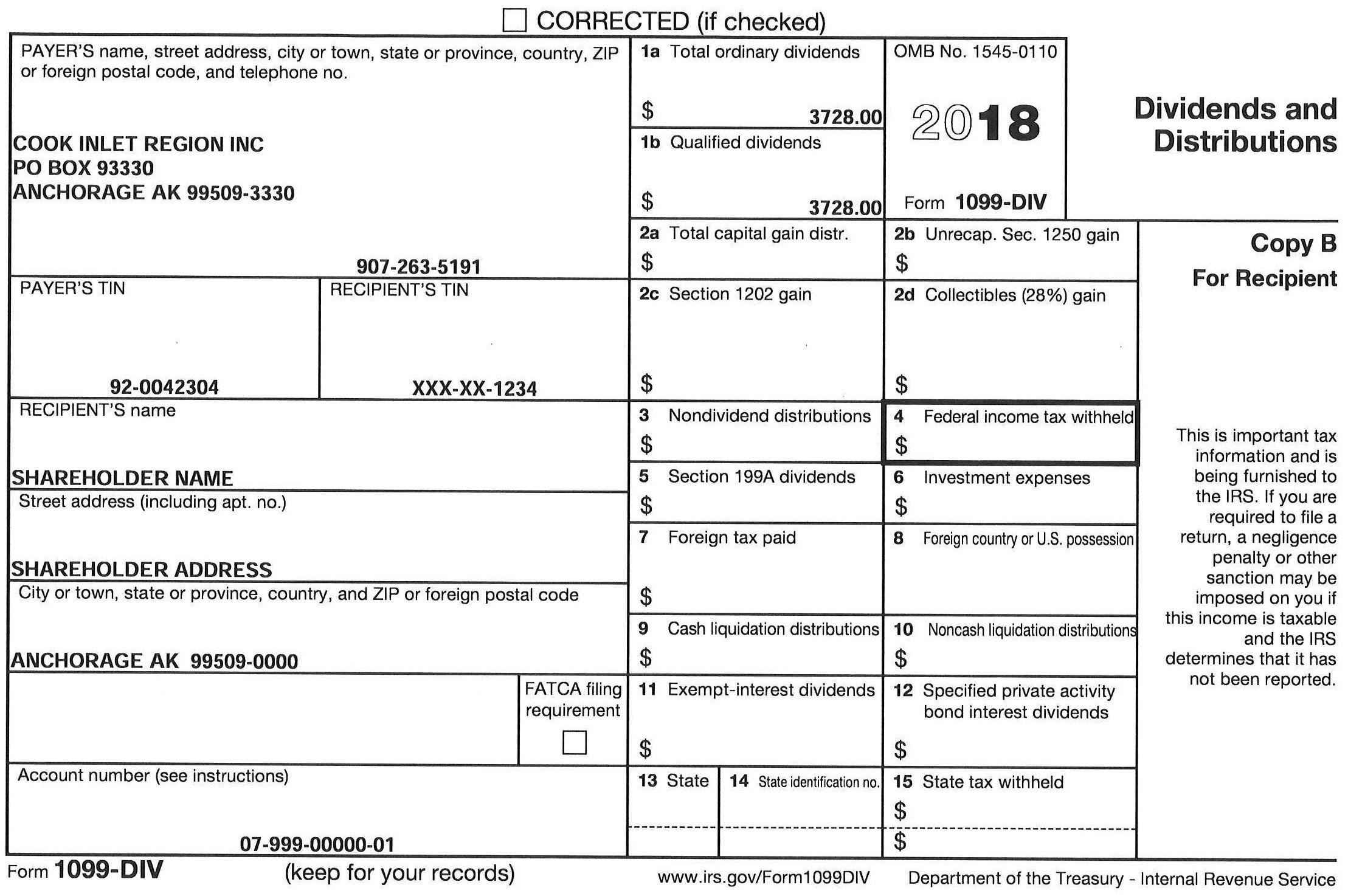

IRS 1099 forms for the 2018 tax year will be mailed to shareholders on Jan. 31, 2019. Please note that you may receive more than one type of Form 1099, depending on the type of income received from CIRI, and the proper IRS forms and schedules to use when completing your tax return may vary depending on the types of CIRI payments received.

In addition to receiving paper copies by mail, shareholders with Qenek portal accounts will be able to view and print their 1099s before the forms are mailed. Tax information remains accessible in Qenek for six years, allowing shareholders to quickly and easily reprint their forms, if desired. To create a Qenek account and become eligible for quarterly prize drawings, visit the CIRI website and click on the Qenek link, or type https://Qenek.ciri.com into your browser.

CIRI’s IRS Forms 1099 reflect all 2018 payments, including:

- Quarterly dividends (reported in Boxes 1a and 1b on Form 1099-DIV)

- CIRI Elders’ Settlement Trust distributions (reported in Boxes 1a and 1b on Form 1099-DIV)

- 7(j) resource payments (reported in Box 3 on Form 1099-MISC)

- Shareholder prizes (reported in Box 3 on Form 1099-MISC)

In 2018, CIRI paid $37.28 per share (or $3,728 per 100 shares) in quarterly dividends, which were reported on a 1099-DIV in both Box 1a – Ordinary Dividends, and Box 1b – Qualified Dividends. Distributions received in 2018 from the Elders’ Benefit Program are also reported by CIRI on a Form 1099- DIV in both Box 1a and Box 1b. The Box 1a amount is the total of all taxable distributions CIRI paid for dividends and Elders’ Benefit Program distributions. Box 1b shows the same amount and may qualify for a reduced tax rate. If you have held your shares for less than one year, please consult your tax advisor regarding the proper treatment of qualified dividends.

CIRI Elders’ Settlement Trust payments had both a taxable and nontaxable portion, with the taxable portion reported in Boxes 1a and 1b on a 1099-DIV. The nontaxable portion was taxed at the Elders’ Trust level and does not need to be reported by you. If you received all four Elders’ Trust payments last year, $1,279.09 is reported in Boxes 1a and 1b, and the remaining $520.91 is nontaxable and is not reported on a 1099-DIV.

If you inherited shares during 2018, you may have an amount reported in Box 3 – Nondividend Distributions on the 2018 Form 1099-DIV. In some circumstances, depending upon an individual’s tax “basis” in their stock, some or all of the Box 3 total could be subject to tax. Please consult your tax advisor for the appropriate treatment of distribution totals reported in Box 3.

Shareholders who owned at-large stock received a $16.3908 per share (or $1,639.08 per 100 shares) 7(j) resource revenue payment in 2018. If you are an at-large shareholder, your 7(j) payment is reported on a Form 1099-MISC in Box 3 – Other Income. The resource revenue payment derives from resource sharing among the 12 regional corporations as required by the Alaska Native Claims Settlement Act. Your 7(j) payment appears on a different form because resource revenue payments are not dividends and are not considered investment income. ANCSA requires that resource revenue be paid to village shareholders’ village corporations, so that CIRI does not report these payments as individual shareholder income. CIRI reports payments made in 2018 to shareholders for prizes or awards on Form 1099- MISC in Box 3 – Other Income.

Remember, it is your responsibility to accurately report your CIRI income on your tax returns. CIRI cannot provide tax advice. Shareholders are encouraged to consult with a tax advisor regarding individual circumstances and applicable federal and state tax requirements.