IRS 1099 forms for the 2019 tax year will be mailed to shareholders on Jan. 31, 2020. Please note that you may receive more than one type of Form 1099 depending on the type of income received from CIRI.

In addition to receiving paper copies by mail, shareholders with Qenek portal accounts were able to view and print their 1099s before the forms were mailed. Tax information remains accessible in Qenek for six years, allowing shareholders to quickly and easily reprint their forms, if desired. To create a Qenek account and become eligible for quarterly prize drawings, visit the CIRI website and click the Qenek link, or type https://Qenek.ciri.com into your browser.

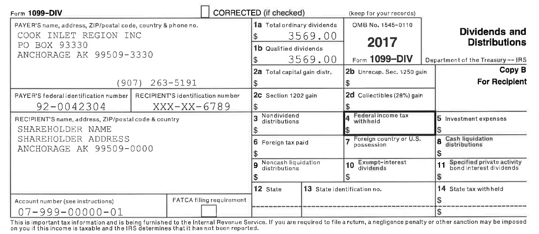

CIRI’s IRS Forms 1099 reflect all 2019 payments, including:

- Quarterly dividends (reported in Boxes 1a and 1b on Form 1099-DIV)

- CIRI Elders’ Settlement Trust distributions (reported in Boxes 1a and 1b on Form 1099-DIV)

- 7(j) resource payments (reported in Box 3 on Form 1099-MISC)

- Shareholder prizes (reported in Box 3 on Form 1099-MISC)

In 2019, CIRI paid $18.06 per share (or $1,806 per 100 shares) in quarterly dividends (first and second quarter), which were reported on a 1099- DIV in both Box 1a – Ordinary Dividends, and Box 1b – Qualified Dividends. Distributions received in 2019 from the CIRI Settlement Trust (CST) for the third and fourth quarter are considered nontaxable and are not reported on a 1099-DIV. The CST paid $19.54 per share (or $1,954 per 100 shares) in quarterly nontaxable distributions in 2019. Distributions received in 2019 from the Elders’ Benefit Program are also reported by CIRI on a Form 1099-DIV in both Box 1a and Box 1b. The Box 1a amount is the total of all taxable distributions CIRI paid for dividends and Elders’ Benefit Program distributions. Box 1b shows the same amount and may qualify for a reduced tax rate. If you have held your shares for less than one year, please consult your tax advisor regarding the proper treatment of qualified dividends.

CIRI Elders’ Settlement Trust payments had both a taxable and nontaxable portion, with the taxable portion reported in Boxes 1a and 1b on a 1099-DIV. If you received all four Elders’ Trust payments last year, $1,489.24 is reported in Boxes 1a and 1b, and the remaining $310.76 is nontaxable and is not reported on a 1099-DIV.

Shareholders who owned at-large stock received a $19.2334 per share (or $1,923.34 per 100 shares) 7(j) resource revenue payment in 2019. If you are an at-large shareholder, your 7(j) payment is reported on a Form 1099-MISC in Box 3 – Other Income. The resource revenue payment derives from resource sharing among the 12 regional corporations as required by the Alaska Native Claims Settlement Act. Your 7(j) payment appears on a different form because resource revenue payments are not dividends and are not considered investment income. ANCSA requires that resource revenue be paid to village shareholders’ village corporations, so that CIRI does not report these payments as individual shareholder income. CIRI reports payments made in 2019 to shareholders for prizes or awards on Form 1099-MISC in Box 3 – Other Income.

Remember, it is your responsibility to accurately report your CIRI income on your tax returns. CIRI cannot provide tax advice. Shareholders are encouraged to consult with a tax advisor regarding individual circumstances and applicable federal and state tax requirements.