2024 Shareholder and Descendant Programs

CIRI programs aim to preserve and share culture, strengthen the CIRI family, and offer education and leadership opportunities.

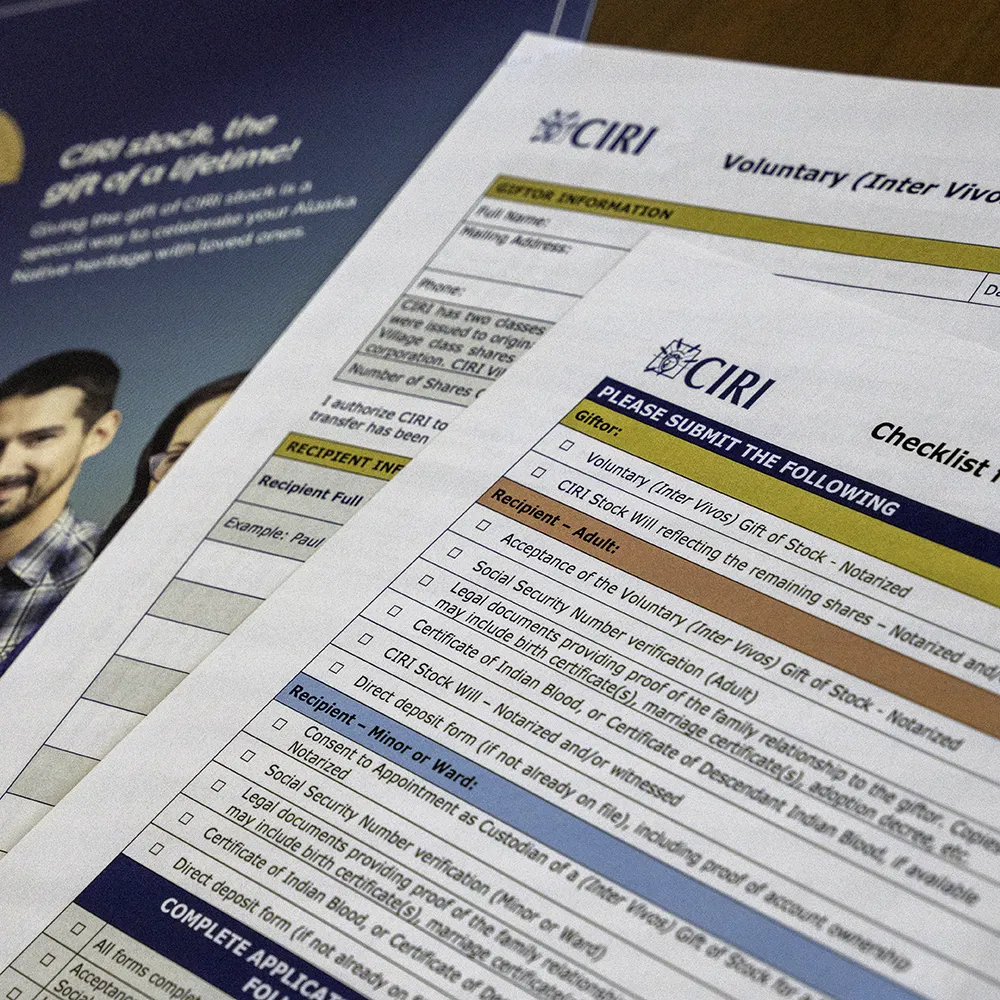

Giving the gift of CIRI stock (also known as an Inter Vivos gift) is a special way to share your heritage with loved ones, help preserve our Alaska Native culture, and strengthen ties with future generations of CIRI Shareholders.

If you are a CIRI Shareholder and would like a gifting packet mailed to you, please submit a request form.

We’ve compiled a list of frequently asked questions along with helpful answers. If you can’t find the information you are looking for, contact the Shareholder Relations team.

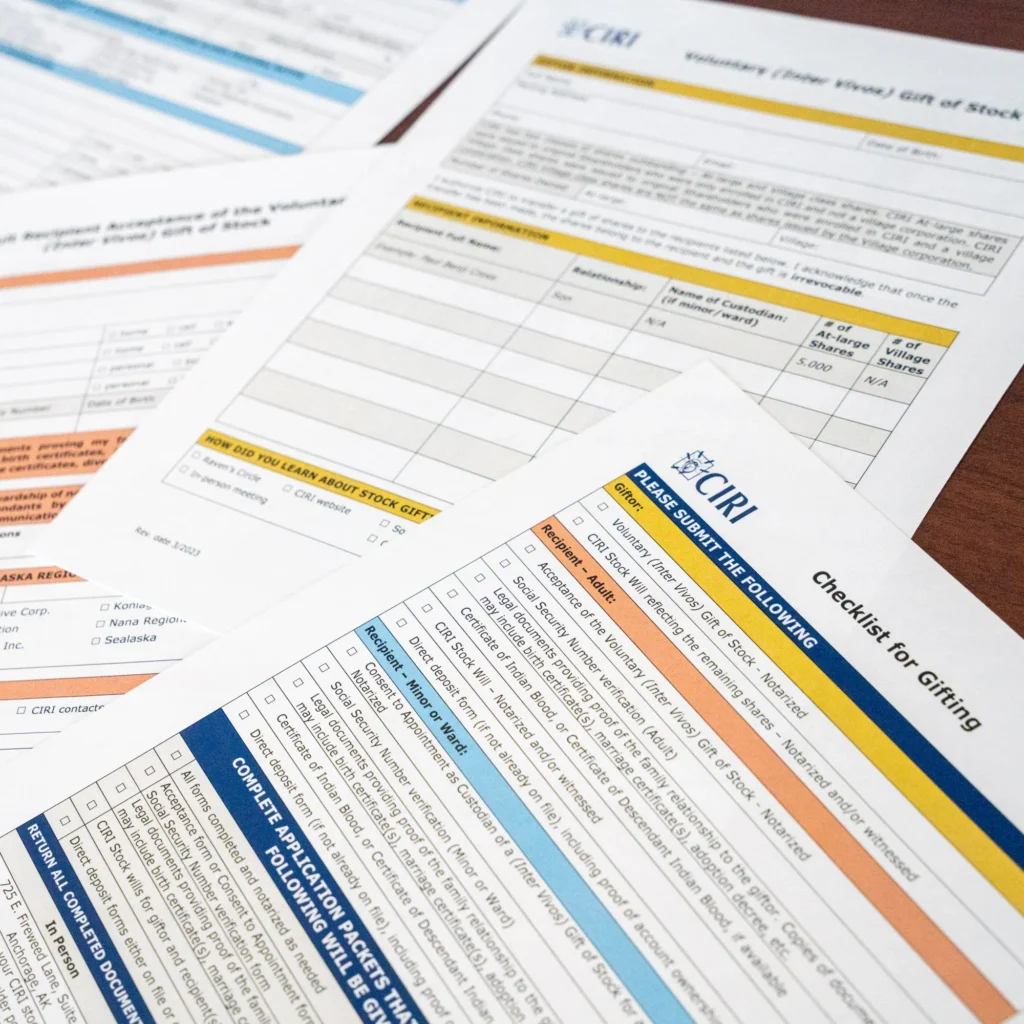

We’ve put together a checklist and forms to help you through the process.

If you are a CIRI Shareholder and would like a gifting packet mailed to you, please submit a request form. Shareholders may also download the necessary forms below.

An “Inter Vivos gift” is a voluntary gift of stock, transferring shares from one living person to another without payment or other consideration. This means you cannot be promised or accept anything of value in exchange for the shares.

If you are 18 or older, you can gift CIRI shares to your child; grandchild; great-grandchild; niece; nephew; brother or sister. The family member who receives your gift must be Alaska Native or the Descendant of a Native and related to the giftor by blood or adoption, not by marriage. As defined in the Alaska Native Claims Settlement Act, an Alaska Native is a citizen of the United States who is a person of one-fourth degree or more Alaska Indian, Eskimo, or Aleut blood, or a combination thereof. Descendant of a Native is defined as a lineal Descendant of a Native or an adoptee of a Native or Descendant of a Native whose adoption occurred before they turned 18. You will need to submit legal documents providing proof of the relationship to the giftor which can include birth certificate(s), marriage certificate(s), adoption decree, etc.

There is no limit to the amount of shares a person can gift, though you cannot gift less than one share. Remember, if you do not keep at least one share, you may be ineligible for certain programs and benefits.

No. Once the gifting transfer is processed, it is irrevocable. This means you lose all rights to the shares and cannot get them back.

No, you do not. The recipient of the shares will have all voting rights, receive all distributions for those shares, and have the right to gift or will those shares. If they should die without leaving a will, the shares will go to that person’s heirs in accordance with Alaska law.

No. If the distributions you receive from your shares are currently subject to attachment pursuant to a court decree of separation, divorce, child support or levy, you cannot gift shares until that order is satisfied.

You and the recipient may be affected by gift or estate tax considerations. CIRI cannot advise you on these matters and will not be responsible for any tax liability resulting from the transfer of your shares. The value of CIRI shares is hard to calculate since CIRI stock is currently restricted from sale so no market value can be assigned to a share of stock. It is suggested that you seek advice from a lawyer or tax advisor if you believe it is warranted in your particular circumstances.

CIRI issued two classes of shares to original Shareholders: village class shares and at-large class shares. Village class shares were issued to original Shareholders who were enrolled in CIRI and a village corporation. At-large class shares were issued to original Shareholders who were only enrolled in CIRI. The significant difference is that annual resource revenue payments for village class shares are sent directly to the village corporation in which the original Shareholder was enrolled. Resource revenue payments for at-large class shares are sent directly to the Shareholder and are considered taxable income.

CIRI programs aim to preserve and share culture, strengthen the CIRI family, and offer education and leadership opportunities.

Throughout the year, I plan to share important updates and information with our Shareholders and Descendants about CIRI’s business operations, financial performance, distributions and more.

Just as subsistence relies on the work of many, so does the continued success of our company.

Learn more and sign up today!